Press Coverage

-

Business World | February 22, 2021

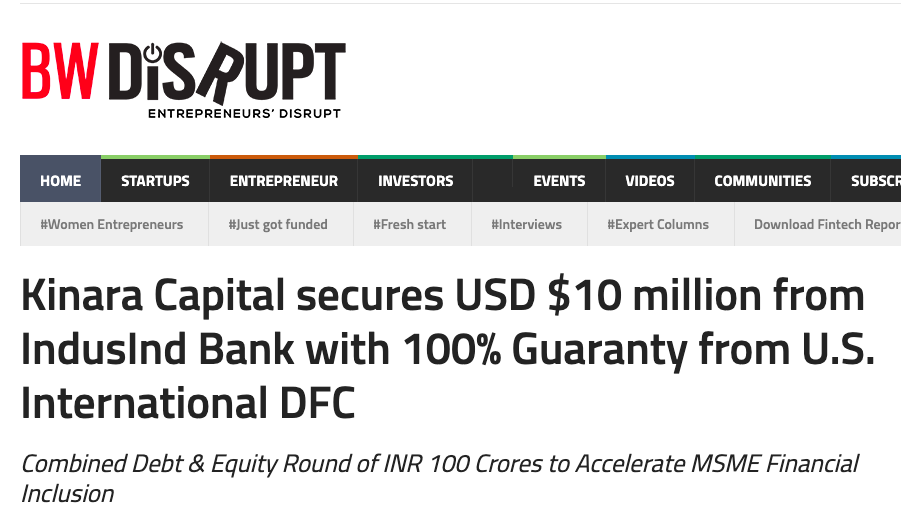

Business World | February 22, 2021Kinara Capital Secures USD 10 Million From IndusInd Bank With 100 Percent Guaranty From U.S. International Development Finance Corporation (DFC)

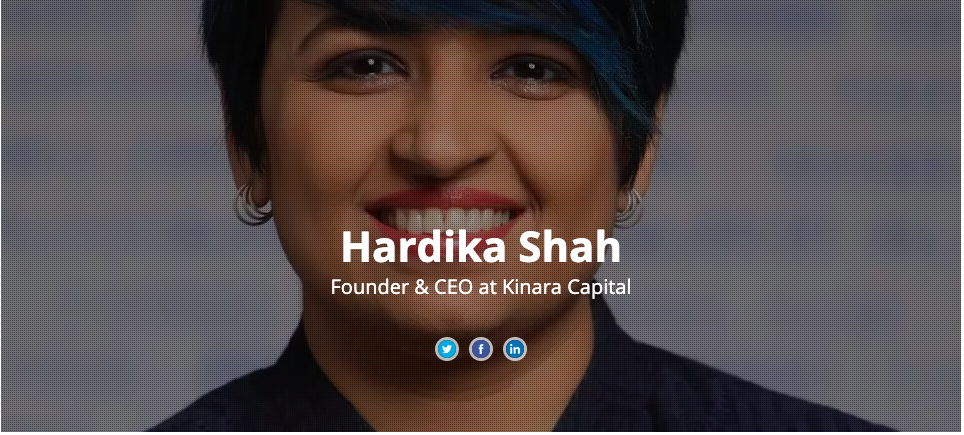

"Kinara lends to MSMEs across manufacturing, trading and services sectors, Hardika Shah, founder and chief executive said. Roopa Satish of IndusInd Bank said the DFC guarantee eliminates forex fluctuation risks from the balance sheet of Kinara and it has become an important tool to mobilise debt funding for impact space companies. Loren Rodwin of DFC said Kinara's commitment towards financial inclusion has made it possible for us to collaborate with India's small businesses. "

Read More Business World | February 22, 2021

Business World | February 22, 2021Kinara Capital Secures USD 10 Million From IndusInd Bank With 100 Percent Guaranty From U.S. International Development Finance Corporation (DFC)

"Kinara lends to MSMEs across manufacturing, trading and services sectors, Hardika Shah, founder and chief executive said. Roopa Satish of IndusInd Bank said the DFC guarantee eliminates forex fluctuation risks from the balance sheet of Kinara and it has become an important tool to mobilise debt funding for impact space companies. Loren Rodwin of DFC said Kinara's commitment towards financial inclusion has made it possible for us to collaborate with India's small businesses. "

Read More

Money Control | February 22, 2021

Money Control | February 22, 2021Small business lender Kinara Capital secures $10 million from IndusInd Bank

Read More ET CFO | February 2, 2021

ET CFO | February 2, 2021Budget FY22 spurs me to lend more but only to good borrowers

It is a pandemic year, and there is going to be an inflection in terms of spending. The good part is the government spent additional money into capital expenditure, which has long-term benefits. It augers well for the economy if has to reach a $5 trillion target.

Read More Live Mint | January 31, 2021

Live Mint | January 31, 2021Budget 2021: What banks, NBFCs, fintech players expect from FM Sitharaman

The suddenness and velocity of the pandemic has left MSMEs reeling. Even though they are slowly getting back on track, there are high expectations for Budget 2021 to deliver announcements that will help them along on the recovery path. One of the primary issues plaguing MSMEs and the last-mile NBFCs lending to them is the existing liquidity crunch, which has been exacerbated by the pandemic. Our expectation from Budget 2021 is a resolution to rapidly improve the economy by prompting banks to inject more liquidity as well as policy changes that ensure that the capital flows to the MSMEs as intended

Read More ET HR World | January 30, 2021

ET HR World | January 30, 2021CEO Wall

Do the right thing even when no one is watching. Your actions, big and small, determine the culture you create in the workplace. And I always say - Get out of the building! By that I mean, leaders are sometimes too focused on finding solutions. You have to start from ground-up and do your research well before you start problem-solving. Zero in on the problem first because if you start with a preconceived notion, you will just end up finding ways to justify the solution you have come up with. So, get out there and talk to different stakeholders and then start drilling down to the solution.

Read More Inc42 | January 21, 2021

Inc42 | January 21, 2021Better Liquidity, Institutional Framework: Here’s What Lending Startups Expect FM To Address In Union Budget 2021

The rate cuts made by the RBI do not always ensure lower borrowing costs for last-mile NBFCs. This is the case with most of RBI’s Covid-19 relief measures, including the TLTRO scheme. Data reveals that the mandate was meant to provide relief to NBFCs across the board, but the banks deployed more than 70% of the funds raised through it in papers issued by AAA-rated NBFCs. A change in the rating system to address the significant difference in size and operations of different NBFCs may help solve this problem

Read More

Edx Live | January 5, 2021

Edx Live | January 5, 2021The VidyaGyan story: This UP school hand-picks meritorious, underprivileged kids to place them on the track to success

Being from the founding batch of VidyaGyan, I still remember how hesitant I used to feel when it came to talking in English. But teachers were like parents to me. We would campaign in nearby villages and conduct street plays to spread awareness about education and other social issues. I recently completed my MBA and now, I am aspiring to write the UPSC exam

Read More Your Story | December 28, 2020

Your Story | December 28, 2020MSME Finance Week focuses on solutions to challenges around MSME financing

Mention of Kinara Capital

Read More Inc42 | November 28, 2020

Inc42 | November 28, 2020Indian Startup Funding Of The Week [November 23-28]

Mention of Kinara Capital

Read More

Business Standard | November 13, 2020

Business Standard | November 13, 2020Emergency credit line 2.0 to help India Inc revive, expand

"It is a positive measure. At Kinara Capital, we have disbursed nearly Rs. 30 crores so far under ECLGS. The post-lockdown ending, MSMEs are struggling with a liquidity crunch. ECLGS allows last-mile NBFCs like us to provide quick help to small businesses to stabilize and restart their business operations.”

Read More Yahoo Finance | October 28, 2020

Yahoo Finance | October 28, 2020One Woman Army: Meet 7 Solo-Woman Entrepreneurs Who Raised the Largest Funding Amount in India

Mention of Kinara Capital

Read More Financial Express | October 9, 2020

Financial Express | October 9, 2020RBI’s targeted long-term liquidity measures to ease borrowing cost for NBFCs: Industry

"Previously, LTRO/TLTRO funds did not flow down to the lower-rated NBFCs...Specific and clear guidelines on eligibility and a separate carve-out for last-mile MSME-focused NBFCs will be the fastest way to economic recovery"

Read More ET CFO | September 21, 2020

ET CFO | September 21, 2020Kamath Report could be ‘problematic’ for lenders to follow as is, says Kinara Capital CFO

Going forward, the committee can also provide more guidance to the lenders within this prescriptive framework. It can add more ratios depending on how the restructures will play out. It can add more sub sectors and release guidance specifically, which we are sure would evolve over a period of time.

Read MoreKinara Capital is a registered brand of Kinara Capital Private Limited

2024 Kinara Capital. All Rights Reserved

(formerly known as Visage Holdings and Finance Private Limited)Get in touch

- [email protected]Email

- 1800 103 2683Toll Free

Monday - Friday | 9.30AM - 6.00PM

Product

Company Information

Quick Links