Press Coverage

-

Business Standard | May 31, 2022

Business Standard | May 31, 2022Kinara Capital plans to add 700 employees by November

Kinara Capital, a fintech company serving Micro, Small and Medium Enterprises (MSMEs), said on Tuesday it plans to add 700 employees across its 125 branches and Bengaluru head office within the next six months.

Read More ET HR World | May 31, 2022

ET HR World | May 31, 2022Kinara Capital plans to add 700 employees

Fintech company Kinara Capital is on a hiring spree across 90 cities in India. The company plans to add 700 employees across its 125 branches and Bengaluru head office within the next six months.

Read More CNBC | May 29, 2022

CNBC | May 29, 2022Kinara Capital CEO Hardika Shah on Lending to Small Business: CNBC Working Lunch

This choppy market is having ripple effects on startups and small businesses globally. In this Working Lunch on CNBC's Power Lunch, meet Kinara Capital CEO Hardika Shah, who has made it her mission to help small businesses grow.

Read More ET HR World | May 22, 2022

ET HR World | May 22, 2022CEO Wall

Our Founder and CEO Hardika Shah featured on the CEO Wall by ET HR World. Here she shares insights into her journey as a Leader.

Read More ET BFSI | May 10, 2022

ET BFSI | May 10, 2022Impact NBFCs: Why we need them

Our Founder and CEO Hardika Shah quoted in an article in ET BFSI on how impact NBFCs are critical to providing last-mile Financial Inclusion since they specialize in niche financing that is often overlooked by traditional lenders.

Read More Forbes Advisor | May 9, 2022

Forbes Advisor | May 9, 2022Should You Take A Business Loan To Deal With Rising Inflation?

In this month’s article for Forbes Advisor, our Founder and CEO Hardika Shah talks about how business loans can aid businesses to deal with inflation, their benefits, and also the caveats to consider before taking one.

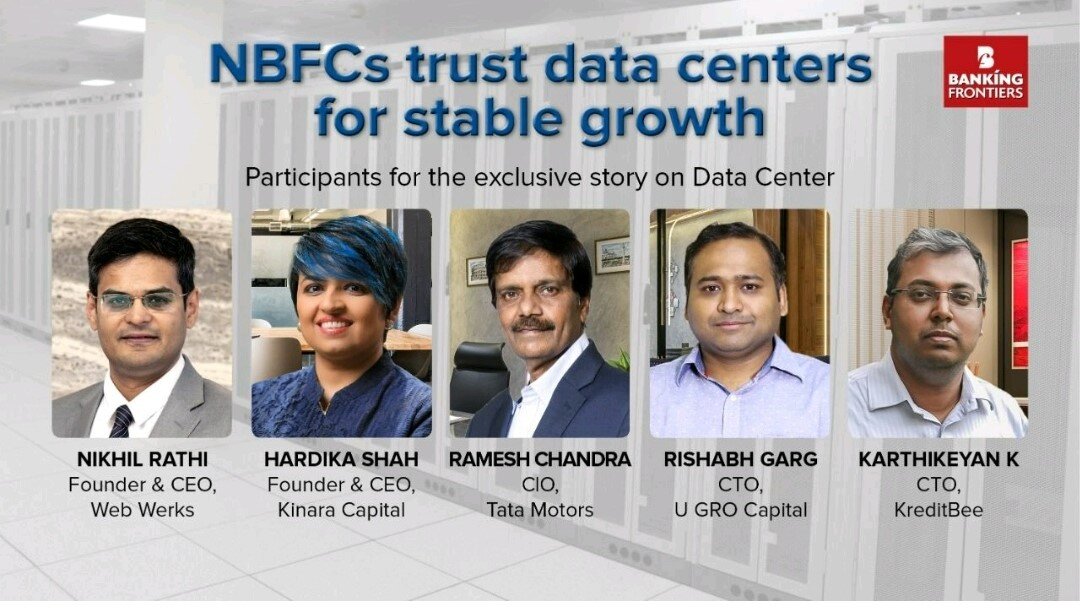

Read More Banking Frontiers | May 1, 2022

Banking Frontiers | May 1, 2022NBFCs trust data centers for stable growth

In an interview with Banking Frontiers, our Founder and CEO Hardika Shah shares her thoughts on the critical and dynamic role of data centers to accelerate the growth of fintech companies in the country.

Read More Deal Street Asia | April 28, 2022

Deal Street Asia | April 28, 2022India’s female founders, co-founders garnered $14.6% of all private funding in 2021

In Deal Street Asia’s inaugural report on the gender funding gap in India, our Founder, and CEO, Hardika Shah shares her views on the rise in funding for fintech and this opening doors for women entrepreneurs.

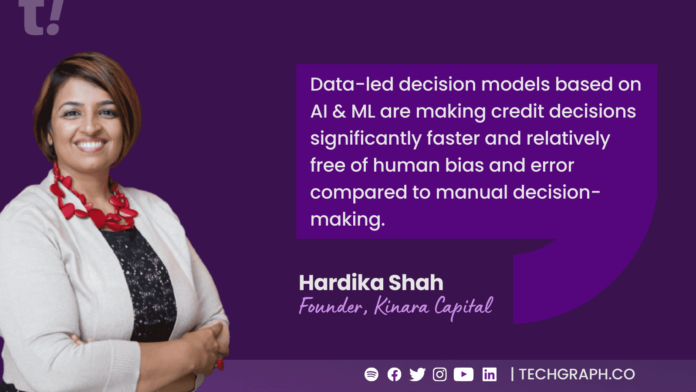

Read More techgraph! | April 28, 2022

techgraph! | April 28, 2022In Conversation With Hardika Shah, CEO & Founder Of Kinara Capital

In conversation with techgraph! - Hardika Shah CEO & Founder of Kinara Capital talks about how Kinara Capital is shaping the NBFC & Small Businesses through its innovative product offerings.

Read More Times of India | April 22, 2022

Times of India | April 22, 2022Optimizing customer experience and engagement is the way forward for digital lending

Featured in the ‘Voices’ section of Times of India, our Founder and CEO Hardika Shah shares insights on methods to create positive customer experience and engagement for digital lending.

Read More Financial Express | April 19, 2022

Financial Express | April 19, 2022Kinara Capital raises Rs 380 cr funding led by investment manager Nuveen; to disburse Rs 2,000 cr MSME loans in FY23

Collateral-free MSME loans provider Kinara Capital on Tuesday said it has raised Rs 380 crore (nearly $50 million) in the latest equity round led by new investors — Chicago-based global investment manager Nuveen with over $1.3 trillion of assets under management (AUM) and Dutch microfinance fund ASN Microkredietfonds advised by impact-focused investment manager Triple Jump.

Read More VC Circle | April 19, 2022

VC Circle | April 19, 2022Kinara Capital raises Rs 380 cr from two new investors led by Nuveen Impact Fund

Small business lender Kinara Capital has raised Rs 380 crore (around $50 million) from two new global investors led by Nuveen Global Impact Fund, along with Dutch investor Triple Jump, the company announced on Tuesday.

Read More YourStory | April 19, 2022

YourStory | April 19, 2022Fintech lender Kinara Capital secures Rs 380 Cr in equity led by Nuveen

Kinara Capital, an MSME fintech, on Tuesday announced that it has raised a fresh equity round of Rs 380 crores led by Nuveen, a global investment manager with over $1.3 trillion of assets under management, with participation from Triple Jump, a Dutch impact-focused investment manager advising the ASN Microkredietfonds.

Read More The Hindu Business Line | April 19, 2022

The Hindu Business Line | April 19, 2022Kinara Capital raises ₹380 crore in funding led by Nuveen

Bengaluru-based Kinara Capital has closed a fresh equity round of ₹380 crore led by Nuveen, a global investment manager, with participation from Triple Jump, a Dutch impact-focused investment manager.

Read More The Economic Times | April 19, 2022

The Economic Times | April 19, 2022Kinara Capital raises Rs 380 crore in funding led by investment manager Nuveen

Collateral-free micro, small & medium enterprise (MSME) loans provider Kinara Capital on Tuesday said it closed a fresh equity round of Rs 380 crore led by global investment manager Nuveen with participation from Dutch microfinance fund ASN Microkredietfonds advised by impact-focused investment manager Triple Jump.

Read More Mint | April 19, 2022

Mint | April 19, 2022Fintech Kinara Capital secures ₹380 crore in equity funding led by Nuveen

Kinara Capital, an MSME fintech, has closed a fresh equity round of ₹380 crores led by Nuveen, a global investment manager with over $1.3 trillion of assets under management (AUM), and with participation from Triple Jump, a Dutch impact-focused investment manager advising the ASN Microkredietfonds.

Read More Money Control | April 19, 2022

Money Control | April 19, 2022Kinara Capital raises Rs 380 crore in equity round led by Nuveen; to disburse Rs 10,000 crore MSME loans in 3 years

Bengaluru-headquartered non-banking finance company (NBFC) Kinara Capital has raised Rs 380 crore via equity in a Series E funding round led by two foreign investors, Nuveen and Triple Jump, it announced on April 19.

Read More Analystics India | April 11, 2022

Analystics India | April 11, 2022Meet the winners of Women in AI Leadership Awards at The Rising 2022

Our Founder and CEO Hardika Shah is a winner at the "Women In AI Leadership Awards" Rising 2022 by Analytics India Magazine - Tech Leaders Driving Disruption & Innovation in Data Science & AI. This award celebrates the importance of women in artificial intelligence and recognizes the incredible impact in the tech community they have made by developing AI solutions.

Read More Financial Times | April 1, 2022

Financial Times | April 1, 2022FT ranking: Asia-Pacific High-Growth Companies 2022

Kinara Capital was featured in Asia-Pacific High-Growth Companies 2022. This fourth annual ranking of 500 of the region’s high-growth companies has been compiled in partnership with research provider Statista.

Read More The Economic Times | April 1, 2022

The Economic Times | April 1, 2022India’s Growth Champions return to the spotlight

Kinara Capital was featured in the Economic Times India’s Growth Champions 2022 list for the third consecutive time. The list represents the crème-de-la-crème of companies that have mastered the art of growing from strength to strength, year after year.

Read MoreKinara Capital is a registered brand of Kinara Capital Private Limited

2024 Kinara Capital. All Rights Reserved

(formerly known as Visage Holdings and Finance Private Limited)Get in touch

- [email protected]Email

- 1800 103 2683Toll Free

Monday - Friday | 9.30AM - 6.00PM

Product

Company Information

Quick Links