If you are a small business owner looking for an MSME business loan, we are here to help you. We have a 1-minute eligibility check on our website, post which a Kinara loan officer will get in touch with you. Our Loan Officer will continue with the process in your desired language and walk you through the process.

Why choose Kinara Capital?

Get MSME loans from ₹1 lakh to ₹30 lakhs with a digital-first process in your preferred language. We serve 4,500+ pincodes and 300+ sectors.

Fast

Get your loan in 24 hours

Flexible

Minimal and flexible documentation process

Friendly

Doorstep customer service to help you from start to finish

Collateral-free MSME Loans

We provide doorstep customer service in Coimbatore and our loan process requires minimum documentation. Our fully digital process can provide you a loan within 24-hours.

-

Tenure

12 to 60 months

-

Rates

Starts at 24%On a reducing rate basis

-

1-30 lakhs

Unsecured business loan in Coimbatore

Coimbatore or Covai is one of the major metros in TamilNadu. The state has an extensive textile industry, and has even been dubbed the ‘Manchester of India’, because Manchester was once the international centre of the world's cotton industry. A range of small manufacturing industries related to cotton and cotton products have emerged in Coimbatore over time. But aside from textiles, Coimbatore also houses manufacturing industries that cater to the engineering sector. Overall, there are over 25,000 small, medium and large industries in the city. But even with such a large crop of MSMEs, traditional lenders in Coimbatore are likely to be averse to lending to small businesses without property collateral. In such circumstances, small business entrepreneurs can rely on Kinara Capital, which provides unsecured business loans in Coimbatore.

Business Loans in Tamil Nadu

Tamil Nadu is the fourth largest state in India, and is best known from its gopuram temples, cuisine and Carnatic music. But the state also has and is well-developed infrastructure and industry, with adequate roadways and ports to support them. Tmail Nadu has a diversified manufacturing sector and ranks among the leaders in industries like automobiles and auto component manufacturing, engineering, pharmaceuticals, paper, fertilizers, cement, garment and textile manufacturing, leather products manufacturing, chemicals, plastics, etc. While there are many large corporations that are based in the state, Tamil Nadu is also home to small businesses, there are also plenty of small businesses engaged in manufacturing, trading and services. To cater to these MSMEs, Kinara Capital offers collateral-free business loans in Tamil Nadu.

How to get a business loan in Coimbatore?

If you are a small business entrepreneur looking to expand their business, you know the importance of having capital readily available.But this is often a challenge because banks refuse to lend to small businesses without property collateral. If your small business is based in Coimbatore, you can approach Kinara Capital for a loan instead. All you have to do to get MSME loans in Coimbatore. Log on to the Kinara Capital website and fill out our 1-minute eligibility check to see if you qualify for a loan. If you do, a loan officer will get in touch with you to complete the process. The MSME loan process at Kinara Capital is quick, easy and requires minimal documentation.

Unsecured Business Loans for MSMEs

Access to capital is a challenge for MSMEs. With a flexible and digital application process, Kinara Capital can provide collateral-free MSME loans in just 24-hours. Multi-lingual support is available throughout the process with doorstep customer service. We provide SME loans to 300+ sectors, across 90+ cities and 3,000 pin codes. Small businesses can avail of our loans to meet a range of business expenses and to expand their operations. Business owners can apply for MSME Loan starting with a quick 1-minute eligibility check.

Our Process

Get a business loan in

3 easy steps!

All you have to do is enter a few details and upload your documents to our secure online portal. We’ll take care of the rest!

-

-

Fast eligibility check

Find out if your business is eligible in just 1 minute! Available in 7 languages. Zero document upload required for eligibility check.

-

Secure KYC & income verification

Provide your personal & business documents. Fully secure online portal with easy upload. Help is at your fingertips with chat or call.

-

Quick loan disbursement

Get money in your account within 24 hours! Digital loan approval with electronic bank deposit.

-

Hear from our Happy Customers

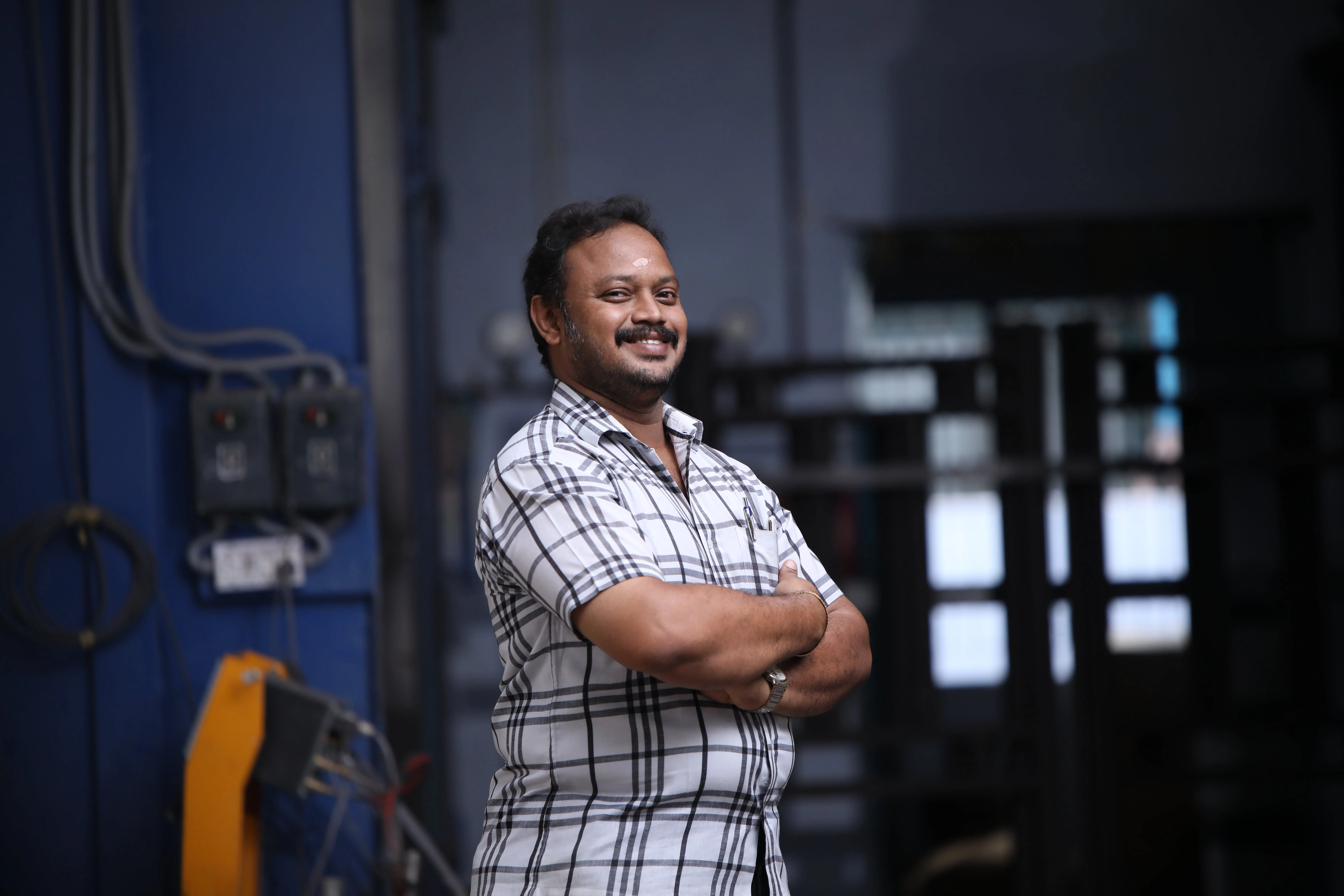

Meet our VikasChampions

With their grit & perseverance, small business owners go on to create local jobs and grow India’s economy. Here’s what they have to say about us!

Karthikeyan AS

ASK Three Star Steels

“We got the funding from Kinara to install a powder coating unit, which triple our turnover from Rs. 1 to Rs. 3 crores a year!”

Tamilselvi

Tamilselvi Appalam Company Tamil Nadu

“My business has been going very well since I got the loans from Kinara Capital. I have even increased the number of workers from 8 to 18.”

Vaishnavi

GainUp Designs

“Nobody was interested in giving us a loan in the early stages of the business except for Kinara. With the loan, we bought an imported machine, which helped us get new buyers and exporters and establish ourselves in our field.”

Frequently Asked Questions

FAQ

-

How to apply for a business loan in Coimbatore?

-

Is Kinara Capital a bank?

-

What are the documents required for availing MSME loans?