Most recent

Goods and Service TaxGSTGST CalculatorGST CertificateGST ProcessGST RegistrationGST Registration BenefitsGST Registration featuresGST Returns

Goods and Service TaxGSTGST CalculatorGST CertificateGST ProcessGST RegistrationGST Registration BenefitsGST Registration featuresGST Returns

A Practical Guide to GST Registration in India

APIsdigital economyDigital Lendingdigital transactionsfinancial servicesopen banking

APIsdigital economyDigital Lendingdigital transactionsfinancial servicesopen banking

India’s Approach to the Open…

Employee GrowthEmployee SpotlightFlexible EnvironmentKinara CapitalTalent TuesdaysTeam Kinara

Employee GrowthEmployee SpotlightFlexible EnvironmentKinara CapitalTalent TuesdaysTeam Kinara

Kinara Capital Employee Spotlight –…

-

December 28, 2022 English (EN)

A Practical Guide to GST…

A tax on products and services used in India is known as the Goods and Service Tax (GST). In India, the service tax, VAT, and excise duty have all been replaced with the GST, an indirect tax.

Read More -

September 30, 2022 English (EN)

India’s Approach to the Open…

In recent years, India has made rapid progress toward open banking. This headway is apparent in government initiatives, bank launches of scalable open banking projects, neobank traction, and the funding and scaling-up of many banking-as-a-service platforms.

Read More

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

-

September 17, 2022 English (EN)

Kinara Capital’s Customer Success Story…

Machine tools are known as “mother machines'' as they are instrumental in creating the building blocks for a wide range of machinery and equipment. They are used to carry out a wide range of functions like cutting, drilling and grinding.

Read More -

May 29, 2023 English (EN)

Applying for Collateral-free Business Loan…

All business owners face challenges. Raising collateral free Business Loan, building teams, finding the right market, to name a few. Do you know any business person who hasn't faced any problems? No, right? But the reason why women entrepreneurship needs to be stressed is that women face a whole new set of challenges: social difficulties,

Read More

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Business Loanscollateral-free loansCustomer Success StoryFundingYourFutureMSME entrepreneursMSME LoansVikas Champions

Business Loanscollateral-free loansCustomer Success StoryFundingYourFutureMSME entrepreneursMSME LoansVikas Champions

Customer Success Story – Jaanu Industries

Asset PurchaseEquipment financeMachine loanNBFC

Asset PurchaseEquipment financeMachine loanNBFC

Equipment Finance for Small Business:…

asset purchase loansFabrication IndustryMachinery LoanMSMEsOnline LoansSmall Businesses

asset purchase loansFabrication IndustryMachinery LoanMSMEsOnline LoansSmall Businesses

The Importance of Machinery Loans…

-

September 30, 2022 English (EN)

Customer Success Story – Jaanu…

In recent years, India has become the world's fastest-growing economy. This rapid expansion, combined with rising incomes, more spending on infrastructure and increased manufacturing incentives, has boosted the automobile sector.

Read More -

October 18, 2021 English (EN)

Equipment Finance for Small Business:…

Equipment finance or loan is a financial product made available to small business owners to assist them in purchasing new or old machinery and equipment. Also known as asset purchase loans, this type of funding is advantageous for small business owners because it is intended to assist SMEs in scaling up their operations.

Read More

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Business Loancollateral-freeKinara CapitalSmall Business OwnersUnsecured Business Loan

Business Loancollateral-freeKinara CapitalSmall Business OwnersUnsecured Business Loan

Unsecured Business Loan – Why is it the Ideal Option…

Employee GrowthEmployee SpotlightFlexible EnvironmentKinara CapitalTalent TuesdaysTeam Kinara

Employee GrowthEmployee SpotlightFlexible EnvironmentKinara CapitalTalent TuesdaysTeam Kinara

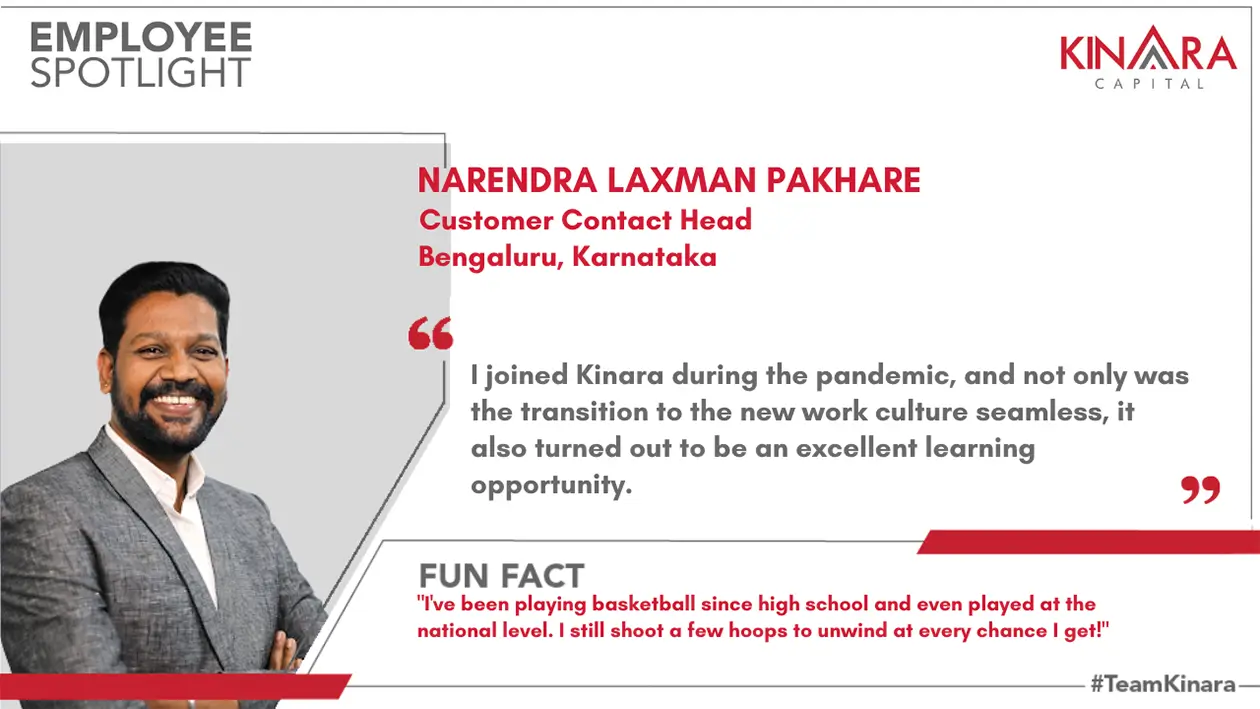

Employee Spotlight – Narendra Laxman…

Business Loans for WomenCollateral-free Business LoansHerVikas business loansLoans for Womenwomen entrepreneurswomen-owned businesses

Business Loans for WomenCollateral-free Business LoansHerVikas business loansLoans for Womenwomen entrepreneurswomen-owned businesses

How do Business Loans for…

-

December 19, 2022 English (EN)

Unsecured Business Loan – Why…

An unsecured Business Loan is a loan granted to businesses based on the borrower's credit history, age, turnover, KYC & income verification, etc., rather than a guarantee or property collateral.

Read More -

December 27, 2022 English (EN)

Employee Spotlight – Narendra Laxman…

The emergence of work-from-home radically altered the way workplaces functioned, and many struggled to adapt to this change. For some employees, however, the transition was not only smooth but also incredibly enriching.

Read More

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

benefits of working capital loancash flowformal lendingFunding Your Futureloan amountraw materialsSmall BusinessesWorking Capital Loan

benefits of working capital loancash flowformal lendingFunding Your Futureloan amountraw materialsSmall BusinessesWorking Capital Loan

Significance of Working Capital Loan for Growing MSME

Business FinancingBusiness Loan EligibilityFintech LoanMSME LoanOnline LoansWorking Capital

Business FinancingBusiness Loan EligibilityFintech LoanMSME LoanOnline LoansWorking Capital

What is Working Capital &…

Business FinancingBusiness Loan EligibilityFintech LoanMSME LoanWorking Capital

Business FinancingBusiness Loan EligibilityFintech LoanMSME LoanWorking Capital

How to Calculate the Working…

-

December 26, 2022 English (EN)

Significance of Working Capital Loan…

The MSME industry is a significant driver of the Indian economy, contributing 30% to the country's GDP and employing around 110 million people. However, despite the large-scale contribution, MSMEs often need help maintaining steady working capital to manage daily business operations and fund growth initiatives.

Read More -

August 28, 2023 English (EN)

What is Working Capital &…

Meeting the short-term obligations of a business enterprise is vital to its long-term survival. Working capital ensures that a business entity has enough funds to manage its daily expenses and stay afloat even during the most challenging times. It enables business owners to fund their business growth without attracting any external debt.

Read More

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Most recent

Grow your business with us

Apply Now

Most popular

-

Unsecured Business Loan – Why…

Team Kinara, | December 19, 2022English (EN)

-

A Practical Guide to GST…

Team Kinara, | December 28, 2022English (EN)

-

How do Business Loans for…

Team Kinara, | December 29, 2022English (EN)

Quick business loans for instant results

Apply Now